Understanding the cash flow statement: A comprehensive guide

A cash flow statement is crucial for understanding a company’s financial health. It shows how cash flows in and out of your business over a period, helping you manage your finances effectively. In this article, we will break down what a cash flow statement is, why it matters, and how you can use it to make informed financial decisions. Additionally, cash flow statements are essential for evaluating a company's financial performance.

Key takeaways

- A cash flow statement details how cash enters and leaves a business during a specific period, offering insights into its liquidity and financial stability.

- The statement is divided into three key sections: Operating Activities, Investing Activities, and Financing Activities, each providing unique insights into different aspects of a company's financial performance and cash management.

- Cash flow statements are essential for financial planning and decision-making, helping businesses predict cash shortages and surpluses, manage operational expenses, and optimise financial strategies.

What is a cash flow statement?

A cash flow statement, also known as the statement of cash flows, is a financial report that provides a detailed account of how cash enters and leaves a business during a specific reporting period. This crucial document summarises the inflow and outflow of cash within a company, offering a clear picture of its liquidity and financial stability. Unlike other financial statements, the cash flow statement focuses solely on cash transactions, revealing which parts of the business generated cash and which parts spent cash during the given period. It is a critical tool for assessing a company's financial performance.

The cash flow statement serves as a financial compass, guiding businesses through the complex terrain of financial management. It reveals how cash is generated from everyday operations, how it’s reinvested back into the business, and how it’s allocated in financing efforts. This comprehensive view allows companies to track their cash position, understand their liquidity, and make informed decisions about future investments and expenditures.

The cash flow statement, with its visibility into future costs and routine expenditures, serves as a vital instrument for evaluating and maintaining a business’s financial health.

Importance of cash flow statements

In the realm of business finance, the significance of cash flow statements is paramount. These documents serve as a financial lifeline, providing critical insights into a company’s ability to generate cash to pay its debts and manage operating expenses. While profit is often seen as the ultimate measure of success, cash flow is the lifeblood that keeps a business running day-to-day. A cash flow statement helps show if a business can cover essential expenses like bills and employee wages, ensuring its continued operation and growth. Additionally, cash flow statements provide insights into a company's financial performance, highlighting its overall financial health.

For investors and creditors, cash flow statements are a goldmine of information. They use these documents to assess whether a company is on solid financial ground, guiding their investment choices and lending decisions. By examining working capital and cash flow patterns, businesses can meet short-term obligations and capitalise on their assets more effectively.

Moreover, cash flow statements enable companies to project future cash positions, helping them avoid debilitating cash shortages and make the most of any cash surpluses. This forward-looking aspect of cash flow analysis is invaluable for strategic planning and financial decision-making.

Key components of a cash flow statement

Understanding the key components of a cash flow statement is fundamental to appreciating its potency. The cash flow statement is commonly divided into three primary sections. These sections include Operating Activities, Investing Activities, and Financing Activities. Each of these sections provides unique insights into different aspects of a company’s cash management and financial strategy. Understanding the key components of a cash flow statement is crucial for evaluating a company's financial performance.

A deeper analysis of these components will reveal their importance and the insights they provide into a company’s financial health.

Operating activities

The Operating Activities section is often considered the heart of a cash flow statement. It reflects the cash generated or spent through a company’s core business operations. This section provides a clear picture of how well a company’s primary business activities are performing in terms of generating cash. It includes cash receipts from sales, interest payments, and tax payments, giving a comprehensive view of the day-to-day cash movements within the business. Additionally, the Operating Activities section provides critical insights into a company's financial performance.

One of the key aspects of the Operating Activities section is how it handles changes in current assets and liabilities. For instance, an increase in accounts receivable is subtracted from net income, as it represents money earned but not yet received in cash. Conversely, an increase in accounts payable is added back to the cash on hand, as it represents money owed but not yet paid out. These adjustments help to reconcile the difference between accrual accounting (used in the income statement) and cash accounting, providing a true picture of the cash generated from operations.

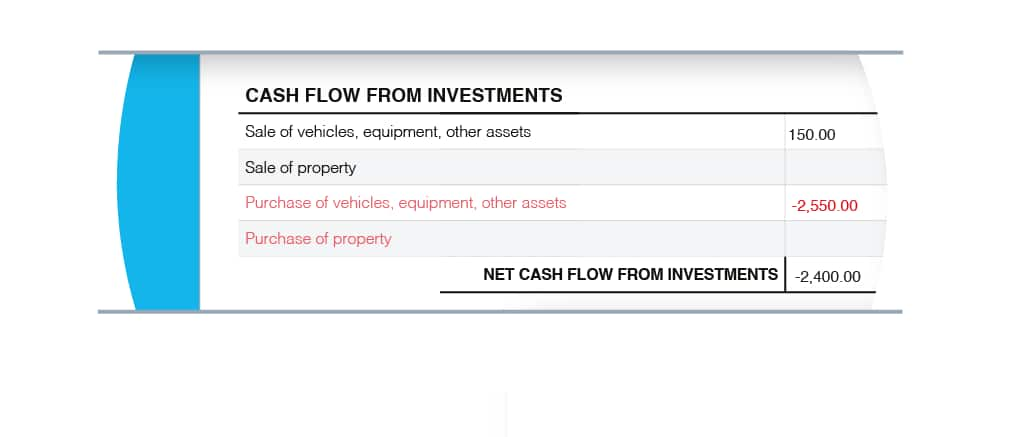

Investing activities

The Investing Activities section in a cash flow statement includes cash flows associated with the purchase and sale of long-term assets and other investments that are not considered as cash equivalents. This section provides insights into the company’s capital expenditure and investment decisions. This section provides insights into how a company is allocating its resources for long-term growth and development. It includes transactions such as purchasing equipment, real estate, or land, as well as selling long-term investments. Additionally, the Investing Activities section provides critical insights into a company's financial performance.

Capital expenditure (CapEx) is a crucial component of the Investing Activities section. An increase in CapEx indicates that a company is investing in its future operations, which can be a positive sign for long-term growth. However, it also shows a decrease in the company’s cash flow in the short term due to the cash spent on these investments. This trade-off between short-term cash outflows and potential long-term benefits is a key consideration for investors and analysts when evaluating a company’s financial strategy.

The Investing Activities section also includes cash inflows from the sale of assets, businesses, and securities, providing a complete picture of how a company is managing its long-term investments.

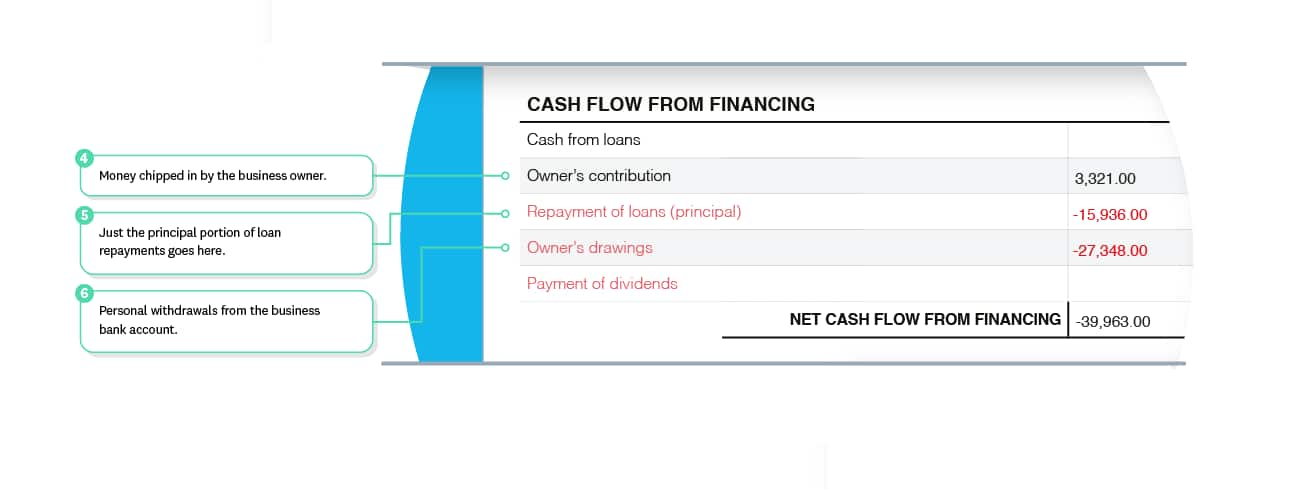

Financing activities

The Financing Activities section of a cash flow statement focuses on the cash flows related to both debt and equity financing. This section provides crucial insights into how a company is managing its capital structure and relationships with investors and creditors. It includes transactions such as:

- raising cash through loans or issuing bonds (a cash inflow)

- repaying long-term debt (a cash outflow)

- paying interest to bondholders (a cash outflow

- issuing equity (a cash inflow)

- repurchasing equity (a cash outflow)

Additionally, the Financing Activities section provides critical insights into a company's financial performance.

One of the key components of the Financing Activities section is dividend payments, which represent a significant cash outflow for many companies. The ability of a company to cover future loan expenses, including interest paid, with available cash, as shown in this section, can reassure investors about the company’s financial stability. By analysing the Financing Activities section, investors and analysts can gain valuable insights into a company’s financial strategy, its reliance on external funding, and its commitment to returning value to shareholders.

Methods of preparing a cash flow statement

When it comes to preparing a cash flow statement, there are two primary methods that companies can use: the direct method and the indirect method. Both methods are accepted under Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), but they differ in their approach and the level of detail they provide.

Comprehending these methods is vital for accurate preparation and interpretation of cash flow statements. Accurate preparation of a cash flow statement is crucial for evaluating a company's financial performance.

Direct method

The direct method of preparing a cash flow statement involves a straightforward approach of adding up all the cash payments and receipts during the reporting period. This method provides a clear and detailed picture of cash flows by showing the major classes of gross cash receipts and gross cash payments. It involves taking all the cash collections from operations and subtracting all the cash disbursements from operations, giving a direct view of the cash movements within the business. Additionally, the direct method provides a clear picture of a company's financial performance.

One of the key advantages of the direct method is its simplicity and clarity. It doesn’t require the starting cash balance, making it easier to prepare in some cases. However, it’s worth noting that even if cash flows are recorded in real-time using the direct method, the indirect method is still needed to reconcile the statement of cash flows with the income statement. This dual approach ensures a comprehensive and accurate representation of a company’s cash flows.

Indirect method

The indirect method of preparing a cash flow statement takes a different approach. It starts with the net income as reported on the income statement and then adjusts for non-cash transactions and changes in balance sheet accounts to arrive at the cash flow from operating activities. This method essentially converts accrual-based net income to cash-based net income by making adjustments for items that affect net income but don’t impact cash flow, such as:

- depreciation

- changes in accounts receivable

- changes in accounts payable

- changes in inventory

By using the indirect method, you can get a clearer picture of the cash flow generated by your business. Additionally, this method provides a comprehensive view of a company's financial performance.

One of the key advantages of the indirect method is that it provides a clear reconciliation between the income statement and the balance sheet, offering a more comprehensive view of a company’s financial statements as a whole. However, it’s worth noting that the indirect method is less accurate than the direct method as it involves adjustments and requires more preparation time.

Despite this, many smaller businesses prefer the indirect method because it requires less legwork and organisation compared to the direct method.

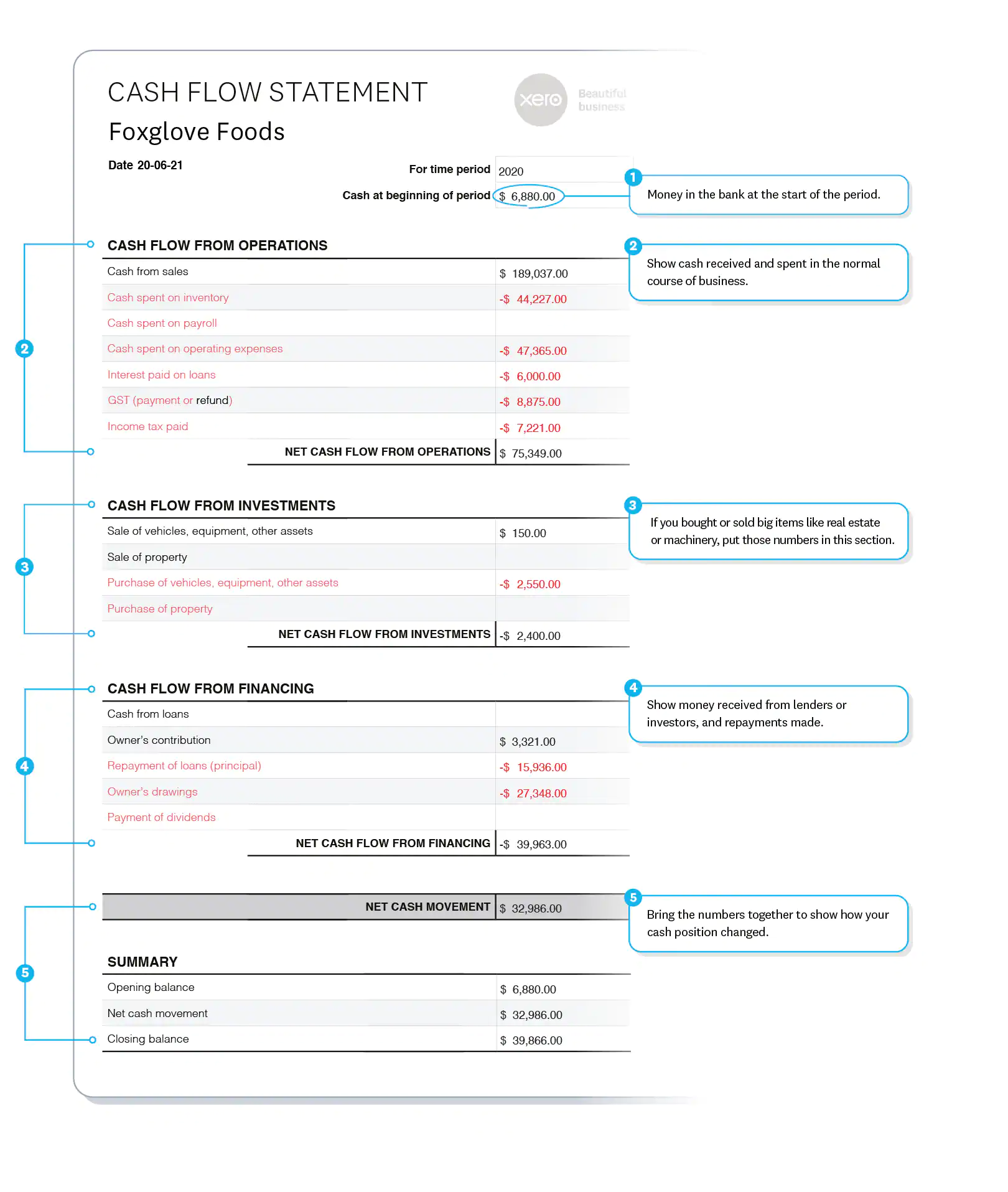

Example of a cash flow statement

To better understand how a cash flow statement works in practice, let’s check out an example. Below, we’ll use Xero's cash flow statement example as an illustration of a comprehensive cash flow statement. This example will help us see how the different components we’ve discussed come together to provide a complete picture of a company’s cash flow. Additionally, this example provides insights into a company's financial performance.

How to read a cash flow statement

Effectively reading a cash flow statement is an essential skill for those involved in business finance or investment. The first step is to understand the overall cash position of the company. Here are some key points to keep in mind:

- A positive net cash flow indicates that the company had more cash flowing into it than out of it during the reporting period.

- A negative net cash flow suggests that the company spent more than it earned.

- However, it’s important to note that positive cash flow doesn’t necessarily mean a company is profitable, and vice versa.

- A company can report a net loss but still have positive cash flow due to cash from borrowings or asset sales.

Cash flow from investments

Display the funds allocated for significant purchases such as real estate and equipment. Also, indicate the revenue generated from the sale of similar items. Sum up these figures to illustrate the net impact of investments on cash flow (often resulting in a negative value).

Cash flow from financing

Display the cash received from lenders and investors, along with the amounts repaid to them. Also, illustrate the cash injected or withdrawn by the owner. Sum up these figures to determine the net impact of financing on cash flow.

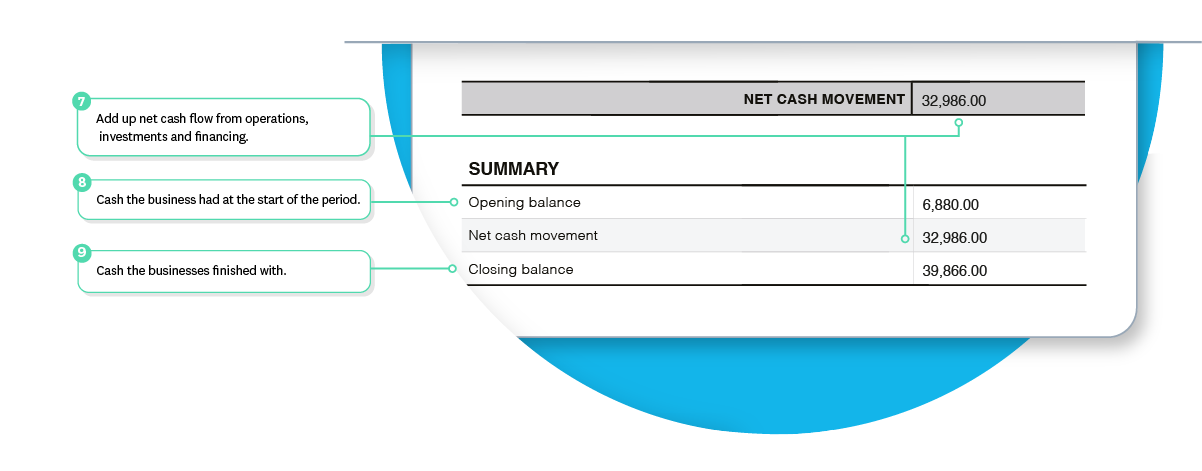

Net cash movement

Consolidate all elements to demonstrate the overall alterations in your cash balance.

Understanding a cash flow statement is crucial for evaluating a company's financial performance.

Analysing changes in cash flow over various periods is vital to gain deeper insights. This helps determine a company’s overall performance and can indicate whether a business is in a growth phase or a state of decline. Pay close attention to the change in net cash for the period, which shows the total amount of cash gained or lost.

Remember, the cash flow statement should not be read in isolation. For a comprehensive understanding of a company’s financial health, it should be considered in concert with the other two primary financial statements: the income statement and the balance sheet. This holistic approach provides a more accurate picture of a company’s financial position and performance.

Negative vs. positive cash flow

Understanding the difference between negative and positive cash flow is crucial for interpreting a company’s financial health. Negative cash flow means more money is going out than coming in during a specific period. While this might sound alarming, it’s important to note that negative cash flow doesn’t always imply poor financial performance. It could be due to:

- significant investments in future growth, leading to higher cash outflow than inflow in the short term

- seasonal fluctuations in revenue and expenses

- changes in market conditions or industry trends

- unexpected expenses or emergencies

- delayed payments from customers or clients

This scenario is particularly common for small businesses and start-ups in their early stages of development.

On the other hand, positive cash flow indicates that a company’s liquid assets are increasing. This allows a company to reinvest in itself, pay off debts, and explore growth opportunities. Positive operating cash flow from operations is particularly important as it indicates that core business activities are generating surplus cash. However, it’s worth noting that positive cash flow isn’t always beneficial in the long term if it comes at the expense of necessary investments in the business. The key is to maintain a balance between having sufficient cash for current operations and investing in future growth.

Creating a cash flow statement

Creating a cash flow statement requires careful gathering and analysis of financial information. The steps involved in creating a cash flow statement are as follows:

- Establish the initial balance of cash and cash equivalents at the start of the reporting period. This helps in accurately tracking the movement of funds throughout the period. This opening cash balance is typically the same as the closing cash balance from the previous year’s statement.

- Gather required financial information such as the income statement and balance sheet.

- Analyse the income statement to determine the net cash provided by operating activities.

- Analyse the balance sheet to determine the net cash provided by investing and financing activities.

- Combine the net cash provided by operating, investing, and financing activities to calculate the net increase or decrease in cash for the period.

- Add the net increase or decrease in cash to the opening cash balance to calculate the closing cash balance for the period.

Creating a cash flow statement is crucial for evaluating a company's financial performance.

By following these steps and calculating cash flow, you can create a comprehensive cash flow statement.

As you work through the process, you’ll calculate cash flows from operating, investing, and financing activities. Each of these sections will require different types of financial data and calculations. For instance, in the operating activities section, you’ll need to account for changes in accounts receivable, inventory, and accounts payable. In the investing activities section, you’ll record cash flows related to the purchase or sale of long-term assets. Finally, in the financing activities section, you’ll document cash flows related to debt and equity financing.

The ending balance of cash and cash equivalents is determined by summing the cash flows from all three activities and adding this to the opening balance. This process provides a clear picture of how cash has moved through the business during the reporting period.

Cash flow statement template

Using a cash flow statement template can significantly streamline the process of creating and maintaining cash flow statements. The primary purpose of using such a template is to:

- Save time and energy in bookkeeping

- Allow businesses to focus more on analysing the results rather than getting bogged down in calculations

- Help plan business payments and manage finances effectively

- Ensure that businesses always have sufficient funds to cover payments

Using a cash flow statement template is crucial for evaluating a company's financial performance.

Moreover, a cash flow statement template can be a powerful tool for financial planning and forecasting. By using the template to enter actual or estimated figures for each item such as sales, debtor receipts, and expenses, businesses can create projections of their future financial position. This allows them to identify payment cycles and seasonal trends, helping to forecast future business finances and predict potential cash shortages or surpluses. By regularly updating and analysing the cash flow statement template, businesses can make more informed decisions about investments, expenditures, and overall financial strategy.

If you like the format of the cash flow statement in this example – Xero can send it to you as a template. Learn more at their website, or click here "Send to me". But, if you want to make a more powerful statement, Xero's reporting features are top notch. By using new cloud accounting software's, businesses can create cash flow statements whenever they want with online accounting. No spreadsheets required.

Cash flow statement vs. income statement vs. balance sheet

Although the cash flow statement is a critical financial document, it’s pertinent to comprehend its correlation and contrast with the other primary financial statements such as the income statement and the balance sheet. These three statements form the cornerstone of financial reporting, each serving a unique role in providing a comprehensive view of a company’s financial health. Understanding the differences between these statements is crucial for evaluating a company's financial performance.

The income statement, often considered the first point of reference for investors or analysts, details a company’s profitability over a specific period by displaying revenues and expenses. However, it’s important to note that the income statement uses accrual accounting principles, which means it records revenues and expenses when they are incurred, regardless of when cash actually changes hands. This can sometimes lead to a disconnect between reported profits and actual cash flow.

The balance sheet, on the other hand, provides a snapshot of a company’s financial position at a particular moment in time. It details the company’s assets, liabilities, and shareholders’ equity, which must balance out (hence the name “balance sheet”). While the balance sheet is useful for understanding a company’s liquidity and financial structure, it doesn’t show revenue, expenses, or daily cash activities. This is where the cash flow statement comes in, bridging the gap between the income statement and balance sheet by focusing on actual cash movements from operating, investing, and financing activities over a period.

By considering all three statements together, investors and analysts can gain a comprehensive understanding of a company’s financial health and performance.

Common mistakes in cash flow statements

Despite their importance in financial analysis, cash flow statements can be susceptible to common errors, potentially misleading users about a company’s financial stability. One frequent mistake is the misclassification of cash flows. For instance, operating cash outflows are sometimes incorrectly treated as investing or financing cash flows. Similarly, investing cash inflows might be mistakenly classified as operating cash flows. These misclassifications can distort the true picture of a company’s cash generation from its core operations versus its investing and financing activities. Avoiding these common mistakes is crucial for accurately evaluating a company's financial performance.

Another common error is the overstatement of operating cash inflows. This can happen when non-cash settlements are incorrectly grossed up or when transactions are netted off instead of being shown separately. Additionally, errors related to foreign currency transactions, such as incorrect translation of cash receipts, can lead to misstated cash flow statements. It’s also crucial to correctly classify items as ‘cash’ or ‘cash equivalents’ - misclassifications often involve term deposits or investments.

Being aware of these common mistakes can help in preparing more accurate cash flow statements and in interpreting them correctly.

Using cash flow statements for financial planning

As invaluable tools for financial planning, cash flow statements offer insights that can influence a company’s strategic decisions. By analysing cash flow statements, business owners can assess their company’s performance and adjust strategies accordingly. One of the primary benefits is the ability to predict cash shortages and surpluses, allowing businesses to plan ahead and ensure they can cover all necessary payments. This foresight is crucial for maintaining smooth operations and avoiding financial crises. Using cash flow statements for financial planning is crucial for evaluating a company's financial performance.

Moreover, cash flow forecasting, which involves estimating future sales and expenses, is a powerful application of cash flow statement analysis. By entering estimated figures for future periods into a cash flow statement template, businesses can create a cash flow forecast. This forecast helps companies understand their future cash position, enabling them to make better-informed decisions about investments and ensuring sufficient liquidity for future needs. It also allows businesses to:

- Manage debt obligations

- Manage operational expenses more effectively

- Provide a clearer picture of cash availability

- Optimise financial strategies

The role of cash flow statements in business operations

In daily business operations, cash flow statements have a central role, offering pivotal insights into a company’s cash management capabilities. They highlight how well a company generates cash, illustrating the movement of money in and out of the business. This information is essential for making informed business decisions, from managing short-term liquidity to planning long-term strategic initiatives. Additionally, cash flow statements are crucial for evaluating a company's financial performance.

On a practical level, cash flow statements help businesses:

- Monitor their spending activities

- Forecast near-term cash flow to meet short-term goals

- Identify opportunities to create additional cash, such as using inventory more efficiently or collecting customer payments faster.

Moreover, cash flow statements are crucial for long-term strategic planning. They help businesses:

- Forecast future cash flows

- Prepare for growth opportunities and challenges

- Analyse past data of cash inflows and outflows

- Make more accurate long-term budgets and financial projections

In essence, cash flow statements serve as a financial compass, guiding businesses through both day-to-day operations and long-term strategic planning.

Summary

In conclusion, cash flow statements are indispensable tools in the world of finance, providing crucial insights into a company’s liquidity, financial health, and operational efficiency. From understanding the basic components of operating, investing, and financing activities to leveraging cash flow analysis for strategic planning, these statements offer a wealth of information for business owners, investors, and financial analysts alike. By mastering the art of creating and interpreting cash flow statements, avoiding common pitfalls, and using them effectively for financial planning, businesses can navigate the complex waters of finance with greater confidence and precision. Cash flow statements are crucial for evaluating a company's financial performance. Remember, in the world of business, cash is king - and the cash flow statement is your royal decree, guiding you towards financial success and stability.

Frequently Asked Questions

What's the difference between the direct and indirect methods of preparing a cash flow statement?

The indirect method of preparing a cash flow statement starts with net income and adjusts for non-cash transactions to arrive at cash flow from operating activities, making it more common and easier to prepare, especially for smaller businesses.

Can a company have positive cash flow but still be unprofitable?

Yes, a company can have positive cash flow but still be unprofitable, especially if it receives cash from non-operational sources while its core business operations are losing money.

How often should a business prepare a cash flow statement?

A business should prepare a cash flow statement quarterly and annually to align with financial reporting, but some companies benefit from preparing them monthly or even weekly for better cash management. It ultimately depends on the specific needs and goals of the business.

What does negative cash flow in the investing activities section usually indicate?

Negative cash flow in the investing activities section usually indicates that a company is investing in long-term assets, such as property, equipment, or other businesses, which can be a positive sign of growth and expansion for the future.

How can small businesses use cash flow statements effectively?

Small businesses can use cash flow statements to monitor their cash position, predict potential cash shortages, and make informed decisions about payments and collections, ultimately helping them manage their liquidity more effectively. Regular review of cash flow can demonstrate financial health and assist in planning for large expenses.

Disclaimer:

Remember, the information in this article is general—it's not one-size-fits-all advice. Understanding your numbers, especially cash flow, can be a complex process and you may been professional support and advice along the way. Always consult your advisor before making decisions based on this piece. The info here is accurate to our knowledge at the time of publishing. For tailor-made advice, don't hesitate to get in touch with us at Trekk Advisory. We're here to help you grow.

.png)