What COVID-19 Has Taught Us About Cash Flow Planning

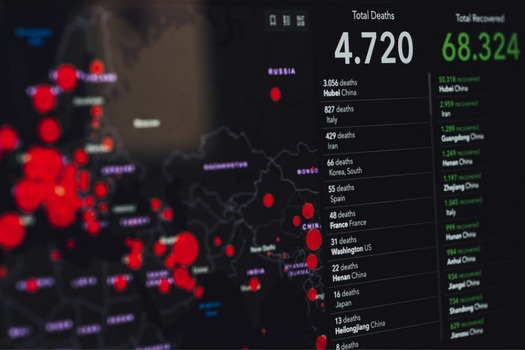

With everything going on right now, it feels like we have no control. And that's scary. But while scientists (and governments) can't predict the future of COVID-19, statistical modelling helps us make sense of the situation and plan for the worst-case scenario.

We can apply these principles to small businesses. Like COVID-19 models, cash flow forecasts provide us with unparalleled insights. Looking ahead (and making intelligent predictions) gives us a sense of how we're performing — and how much cash we have. Sure, we can't predict the future, but we can certainly prepare for it!

What is cash flow forecasting?

There are two types of forecasts you need to know about:

- Short-term forecasts

- Long-term forecasts

Both of these techniques ensure you have enough cash flow to survive, especially during the current financial climate.

Short-term cash flow forecasting

Face it, things are tough right now. Here in Australia, the economy has suffered. For months, flights have ground to a halt, and people have worked from home. Only recently have shops turned on the lights, rolled up the blinds, and opened the doors. We're living in unprecedented times.

The short-term will be shaky for most of us, so we need to manage cash flow more than ever before. Short-term cash flow forecasts give you valuable financial insights for the next year or so. This helps you make smarter decisions about your small business. Should you invest? Sell up? Stay put? Not sure? Cash flow forecasts provide you with much-needed guidance.

Short-term cash flow management is great for all the hard-working retailers in Australia. Shop owners can predict revenue in the coming months, for example. But other business owners will benefit too. Restaurant owners, salon owners, contractors, you name it.

Long-term cash flow forecasting

Long-term cash flow is more difficult to predict. (Few people could have expected COVID-19 this time last year.) However, cash flow forecasts still prove extremely useful.

Long-term forecasts take into account economic peaks and troughs, politics, inflation and, yes, even pandemics. When you incorporate these forecasts into your business, you learn how to withstand big changes that are completely out of your control.

Cash flow forecasts for small business assistance

You know those scientists you see on the TV? They use a mix of short-term and long-term forecasts to predict the future of COVID-19. They make predictions, identify problems, and plan for various outcomes. It's the same thing as cash flow forecasting.

You might know your business inside-out but, as the last few months have taught us all, we need to plan for the future. We just can't "wing it" any more. Anything can happen. Short- and long-term cash flow forecasts help you grow a sustainable business — one that can survive pretty much any situation.

Here are some of the life-changing benefits of cash flow forecasts:

- Keep an eye on your accounts.

- Prepare for different eventualities.

- Track due payments.

- Pay suppliers on time.

- Get paid on time.

- Manage up-front costs.

- Improve your bottom line.

- Assess affordability for new hires/new products/investments.

- Expand your small business.

- Create a roadmap for the weeks, months, and even years ahead.

- Reduce stress.

By adding something called "scenarios" to your forecasts, you won't just have a plan B for your business, but a plan C and D and E. You can make predictions for various outcomes and identify problems before they happen. You'll be able to plan for the future without the uncertainty.

Scenarios are just one of the features you'll find on Futrli, an AI-powered cash flow prediction solution. Use this tool to make sure your business weathers this storm and prepare for future eventualities.

Protip: Trekk works with Futrli and Xero to track forecasts, scenarios, and KPIs. Get in touch with us now, and learn more about how cash flow forecasts ensure the long-term success of your business.

Final word

The future is unknown, but making better plans benefits your business in the short- and long-term. Like COVID-19 statistical models, cash flow predictions prepare us for various scenarios so we have the tools we need to survive.

.png)